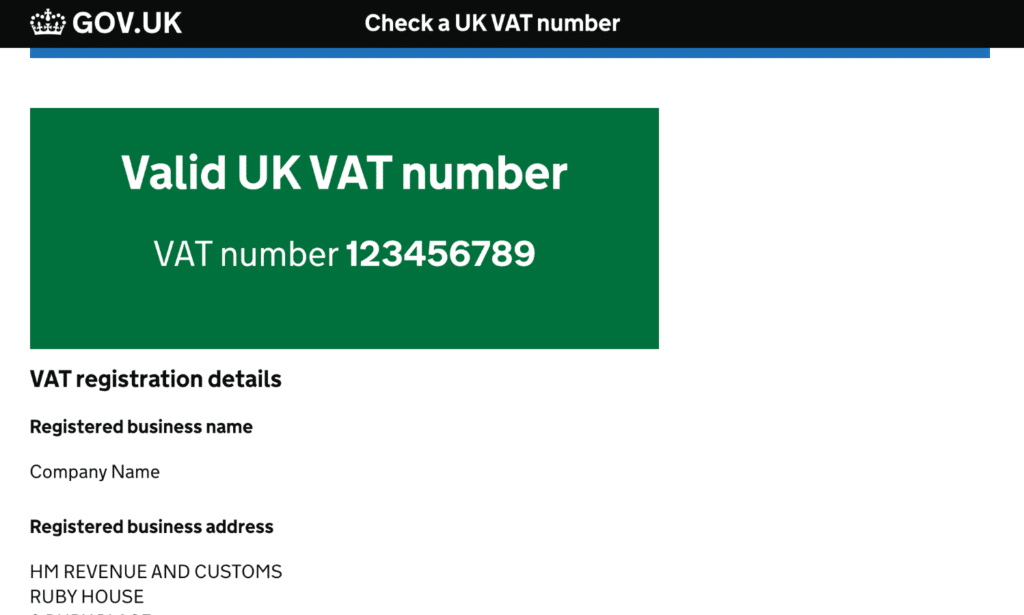

Ebay.co.uk Vat Number . Use this service to check: address on vat registration: 1 more london place, london, greater. If a uk vat registration number is valid. the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. The name and address of the. ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: check a uk vat number. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information.

from woorkup.com

1 more london place, london, greater. address on vat registration: check a uk vat number. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: The name and address of the. ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so. If a uk vat registration number is valid.

VAT for dummies An easy guide for WordPress EDD sellers (EU and UK)

Ebay.co.uk Vat Number If a uk vat registration number is valid. If a uk vat registration number is valid. address on vat registration: the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. 1 more london place, london, greater. The name and address of the. check a uk vat number. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: Use this service to check: ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so.

From xneelo.co.za

Update my VAT number xneelo Help Centre Ebay.co.uk Vat Number If a uk vat registration number is valid. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. Use this service to check: The name and. Ebay.co.uk Vat Number.

From www.youtube.com

HOW TO SHIP EBAY ORDERS TO THE EU EBAY VAT RULES ARE CHANGING JULY Ebay.co.uk Vat Number depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. If a uk vat registration number is valid. address on vat registration: if. Ebay.co.uk Vat Number.

From wise.com

eBay VAT Invoice Wise, formerly TransferWise Ebay.co.uk Vat Number if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. check a uk vat number. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. The name and address of. Ebay.co.uk Vat Number.

From briefly.co.za

VAT number search Simple steps to find the VAT number of a business Ebay.co.uk Vat Number ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. Use this service to check: 1 more london place, london, greater. . Ebay.co.uk Vat Number.

From docs.celigo.com

Sync orders and items for eBay EU VAT as per eBay latest changes Ebay.co.uk Vat Number Use this service to check: check a uk vat number. address on vat registration: ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: 1 more london place, london, greater. ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any. Ebay.co.uk Vat Number.

From freebizlife.com

【VAT徴収ルールに注意】eBay輸出でEMSを利用する3つのメリットと手順を徹底解説! FREE BIZ LIFE Ebay.co.uk Vat Number check a uk vat number. the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on.. Ebay.co.uk Vat Number.

From nari-blog.com

【ebay輸出】VAT・IOSSについてまとめました ナリブログ Ebay.co.uk Vat Number ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. check a uk vat number. address. Ebay.co.uk Vat Number.

From ren-blog.jp

eBay輸出 EUのVATについて れんとテッド Ebay.co.uk Vat Number The name and address of the. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. address on vat registration: check a uk vat number. If a uk vat registration number is valid. Use this service to check: ebay requires that you provide a gross price and. Ebay.co.uk Vat Number.

From www.opti.co.jp

Q,eBayでもUKとEUのVAT登録へのアナウンスがなされたって本当ですか? Ebay.co.uk Vat Number ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. 1 more london place, london, greater. If a uk vat registration number is valid. if. Ebay.co.uk Vat Number.

From www.searche.co.za

How To Check A Company's VAT Number Searche Ebay.co.uk Vat Number the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. 1 more london place, london, greater. Use this service to check: The name and address of the. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following. Ebay.co.uk Vat Number.

From ltheme.com

How to Set up Rules for EU VAT to Sell Physical Products in J2store Ebay.co.uk Vat Number the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to certain items as defined by the uk. check a uk vat number. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: address on vat registration: 1 more london place, london,. Ebay.co.uk Vat Number.

From www.branchor.com

The Ultimate Guide to VAT Numbers What They Are and Why Your Business Ebay.co.uk Vat Number 1 more london place, london, greater. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so. depending. Ebay.co.uk Vat Number.

From www.fiverr.com

Register germany vat number for amazon ebay sellers by Linglongcho Fiverr Ebay.co.uk Vat Number address on vat registration: 1 more london place, london, greater. If a uk vat registration number is valid. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. Use this service to check: ebay is obliged to collect vat on goods sold through ebay to eu customers in. Ebay.co.uk Vat Number.

From novashare.io

How VAT works and is collected (valueadded tax) Novashare Ebay.co.uk Vat Number If a uk vat registration number is valid. address on vat registration: ebay requires that you provide a gross price and separate vat rate when listing on ebay.co.uk or any european ebay site, so. check a uk vat number. the standard uk vat rate is 20%, although reduced rates of 5% and 0% may apply to. Ebay.co.uk Vat Number.

From www.infoautonomos.com

VAT number qué es y cómo se solicita Infoautonomos Ebay.co.uk Vat Number check a uk vat number. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. ebay requires that you provide. Ebay.co.uk Vat Number.

From www.ebay.com.my

Upload VAT Seller Centre Ebay.co.uk Vat Number Use this service to check: check a uk vat number. The name and address of the. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: If a uk vat. Ebay.co.uk Vat Number.

From www.a2xaccounting.com

The Ultimate Guide to eBay VAT (For US, UK, EU Sellers) A2X Ebay.co.uk Vat Number The name and address of the. depending on your yearly sales or number of sales transactions, you may need to provide your tax identification information. if you sell goods in any eu country or in the uk, you may be required to register for value added tax (vat) and to collect vat on. 1 more london place, london,. Ebay.co.uk Vat Number.

From ebaysellercentre.co.id

Cara Upload VAT ID ke My eBay eBay Seller Center Ebay.co.uk Vat Number 1 more london place, london, greater. The name and address of the. Use this service to check: ebay is obliged to collect vat on goods sold through ebay to eu customers in the following circumstances: If a uk vat registration number is valid. ebay requires that you provide a gross price and separate vat rate when listing on. Ebay.co.uk Vat Number.